how to set up a payment plan for maryland taxes

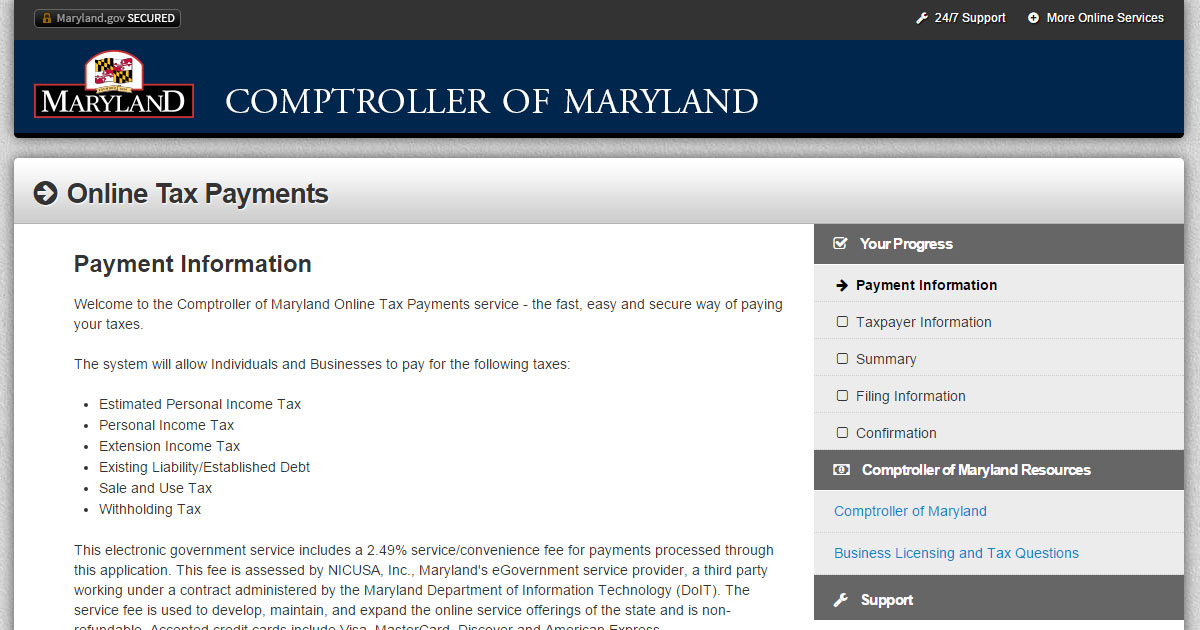

If you already filed or youre unable to find this option in TurboTax you can apply. You may use this service to set up an online payment agreement for your Maryland.

Maryland Comptroller Peter Franchot Offers New Mobile Friendly Tax Payment Service Maryland Gov

File personal income taxes.

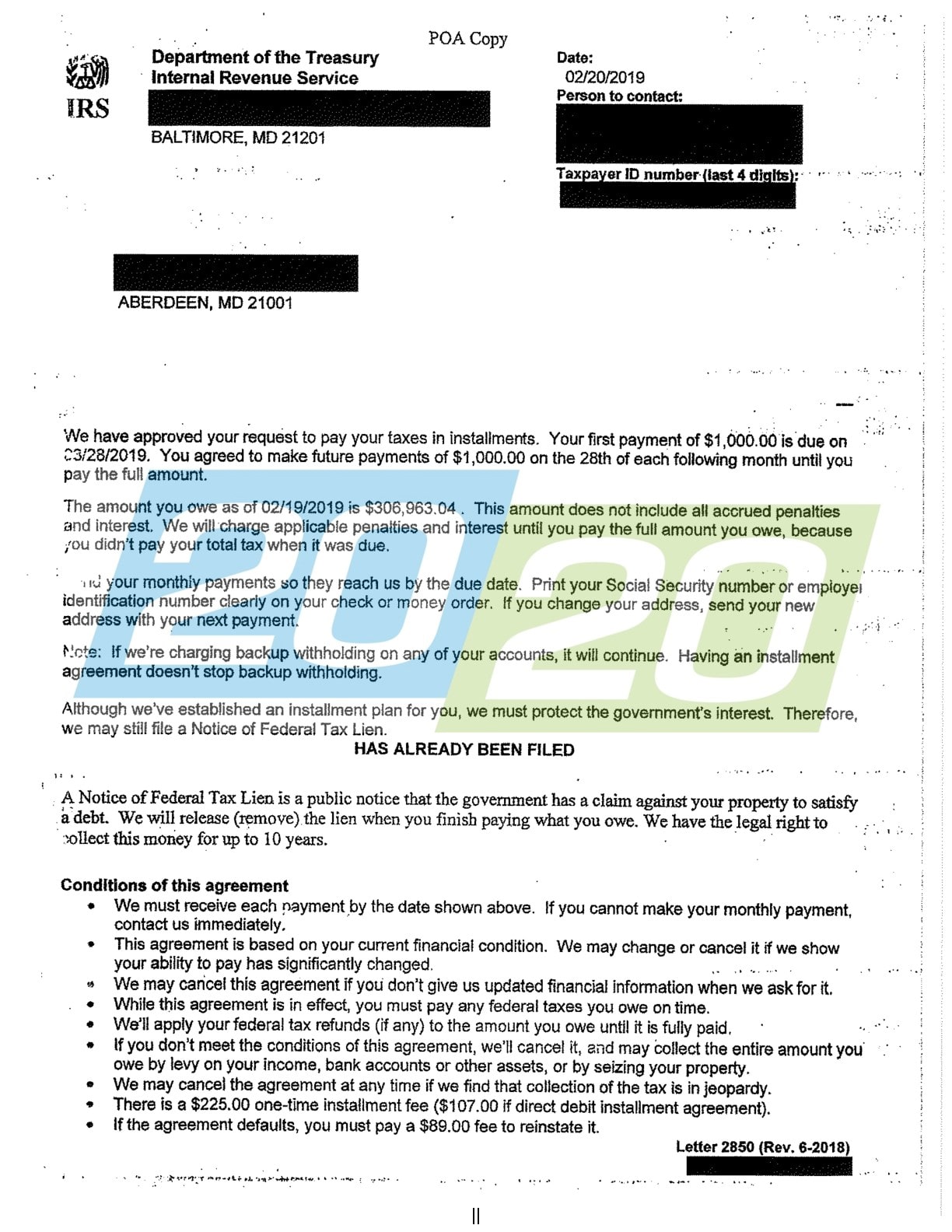

. You may view a history of agreements and automatic payments. The Maryland Comptrollers office is likely to grant you a 24-month window for a Maryland tax payment plan. Department of Revenue Services.

Connecticut State Department of Revenue Services. If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options. If you file and pay electronically by.

For assistance users may contact the Taxpayer Service Section Monday. Select the installment payment plan option Continue and follow the onscreen instructions. The CCU may be able to assist you in arranging a payment plan since the MVA does not offer payment plans.

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. If you need more time youll need to complete Form MD 433-A. You will need your payment agreement number in order to set up an automatic payment for an existing payment agreement.

Monthly payments must be made until the account is paid in full. The Maryland Comptrollers office is more likely to offer you a 24-month payment plan for your state taxes. In order to initiate a payment plan you need to make an initial down payment on each delinquent debt owed.

You can pay your Maryland taxes with a personal check money order or credit card. How Can I Apply for a Payment Plan. You may be required.

Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. If you need more time fill out Form MD 433-A. Visit the website of the Office of the Comptroller and apply.

Call the state comptrollers office at 410-974-2432 or 1-888-674-0016. Set up a recurring debit payment E-check for an existing payment agreement. To qualify for the CCU payment plan you must not owe money to the CCU.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. You may also choose to pay by direct debit when you file electronically.

Maryland Tax Payment Plan Tax Group Center

Amid Coronavirus Concerns Maryland Delays Tax Payments Wtop News

Maryland Employers Covid 19 Financial Guidance Funding Tax Relief

Maryland Comptroller Offers Secure Mobile Online Tax Payment Service Maryland Gov

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/CDR5G67H3FHKXDQUWK3PEDS2JM.JPG)

Deadline For Maryland State Income Tax Payments Extended To July 15 Baltimore Sun

Comptroller Of Maryland Facebook

Irs Accepts Installment Agreement In Aberdeen Md 20 20 Tax Resolution

Governor Larry Hogan Official Website For The Governor Of Maryland

How To Input Maryland Annualized Income

Maryland Lawmakers Tax Relief Plan Leaves Many With Higher State Tax Bills Baltimore Sun

Everything You Need To Know About Amended Tax Returns In Maryland

Maryland Democrats Plan 700m Tax Package To Begin Funding School Changes After Demise Of Large Sales Tax Bill Baltimore Sun

Maryland Llc How To Start An Llc In Maryland In 10 Steps 2022

Maryland Comptroller Extends Certain Business Tax Returns And Payments I95 Business

Maryland Candidates For Governor Debate Taxes Tax Foundation

Maryland Comptroller Peter Franchot Delays Business Tax Payments For 90 Days Baltimore Business Journal