us exit tax form

The Form 8854 is required for US citizens as part of the filings to end. Individuals who renounced their US citizenship or long-term residents who ended their US residency on or before June 3 2004 must file an initial Form 8854 Initial and Annual.

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective.

. You may end up owing an exit tax. Get Tax Forms and Publications. And another country and as of the expatriation date contin-ues to be a citizen of such other country and taxed as a.

Legal Permanent Residents is complex. US Exit Tax Giving Up a Green Card. Get Federal Tax Forms.

The IRS Green Card Exit Tax 8 Years rules involving US. In order to be considered a US expatriate you have to voluntarily renounce your Green Card using form I407 and stating that you no longer wish to live in the United States. The idea of the exit tax is the concept that if a US person falls into one of the two categories of being a Long-Term Resident or US Citizen and 1 they have assets that have accrued in value.

Became at birth a citizen of the US. Exit taxes can be imposed on individuals who relocate. Will be able to meet all requirements in three years for buyers of its electric vehicles to get the.

Exit tax is a term used to describe the tax liability incurred by a person or organization when they leave a country. THE UNITED STATES EXIT TAX 5 a. Get the current filing.

17 hours agoSoccer pitches of forest lost this hour most recent data. If you file your taxes by paper youll need copies of some forms instructions and worksheets. A covered expatriate is someone who meets at.

Giving Up a Green Card US Exit Tax. Nonresident Alien Income Tax Return About Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701b Page Last Reviewed or. Green Card Exit Tax 8 Years.

If you have relinquished your US citizenship or Green Card status you may have to file IRS Form 8854. Green Card Exit Tax 8 Years Tax Implications at Surrender. Yes even if you are not a covered expatriate under the Exit Tax tests and dont owe any Exit Tax you must file Form 8854.

About Form 1040-NR US.

Tax Returns On Hold While Irs Asks Who Are You Agency Also Working With Tax Industry To Fight Filing Fraud Don T Mess With Taxes

What Is Form 8854 The Initial And Annual Expatriation Statement

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Expatriation Tax Form 8854 Is Part Of Criminal Tax Case Tax Expatriation

Us Individual Income Tax Return Form 1040 Fbar Itin Green Card Streamlined Procedures Consulting Exit Tax Us Cpa Japan Sekiyama U S Tax Consulting Llc

Part 6 The 877a Exit Tax While The Non Us Pensions Of Americans Abroad Are Subject To Confiscatory Taxation Us Based Pensions Escape Intact Stop Extraterritorial American Taxation

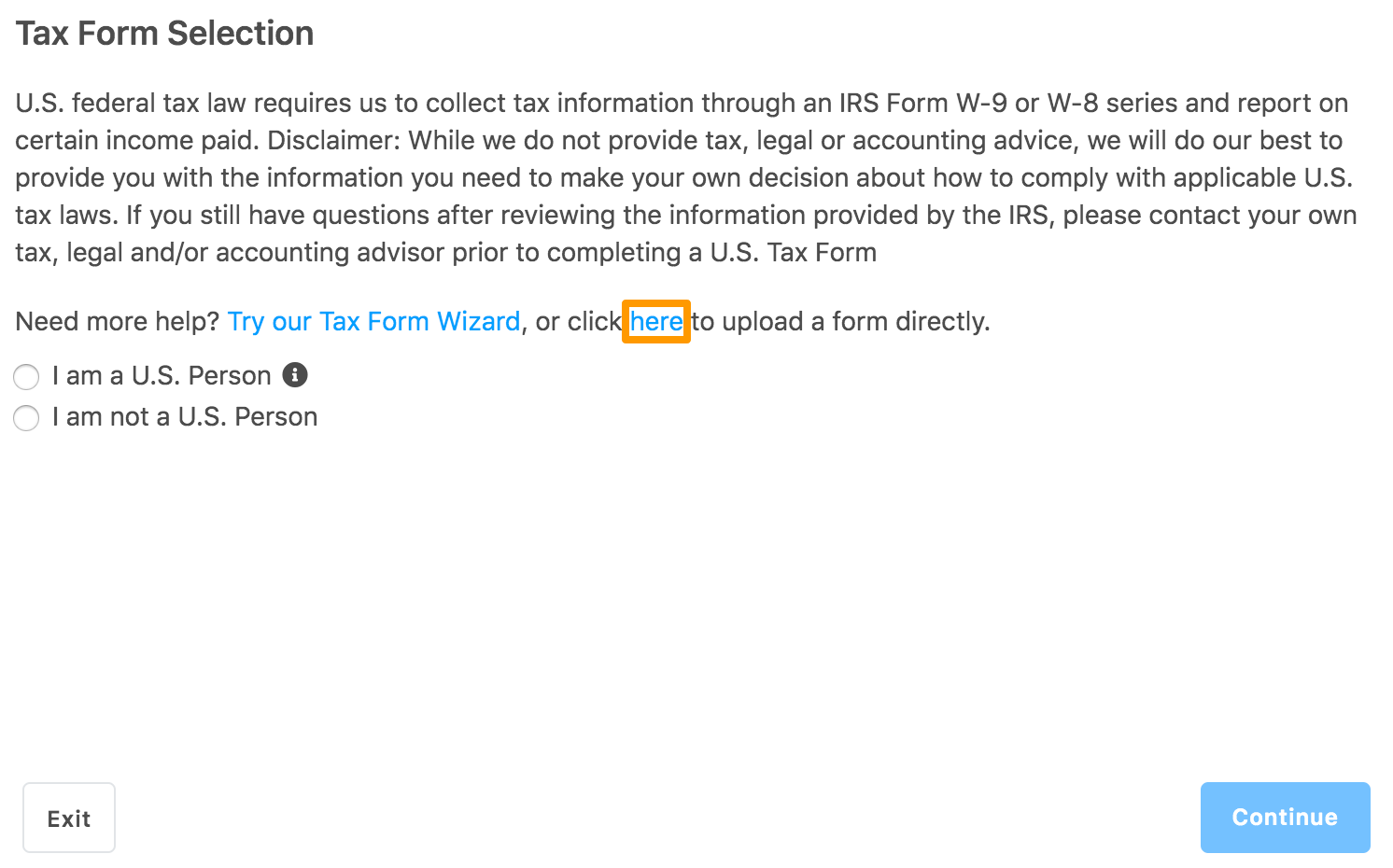

Uploading Your Tax Form Bugcrowd Docs

Do You Qualify For An Exit Tax Refund

Renouncing U S Citizenship What Is The Process 1040 Abroad

Form 8854 For American Expats Expat Tax Online

Us Wealth Tax For Expatriates And How To Exit From It Expatriate Tax Expat Tax Expat Us Tax Expat Tax Advice Expatriate Taxation

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

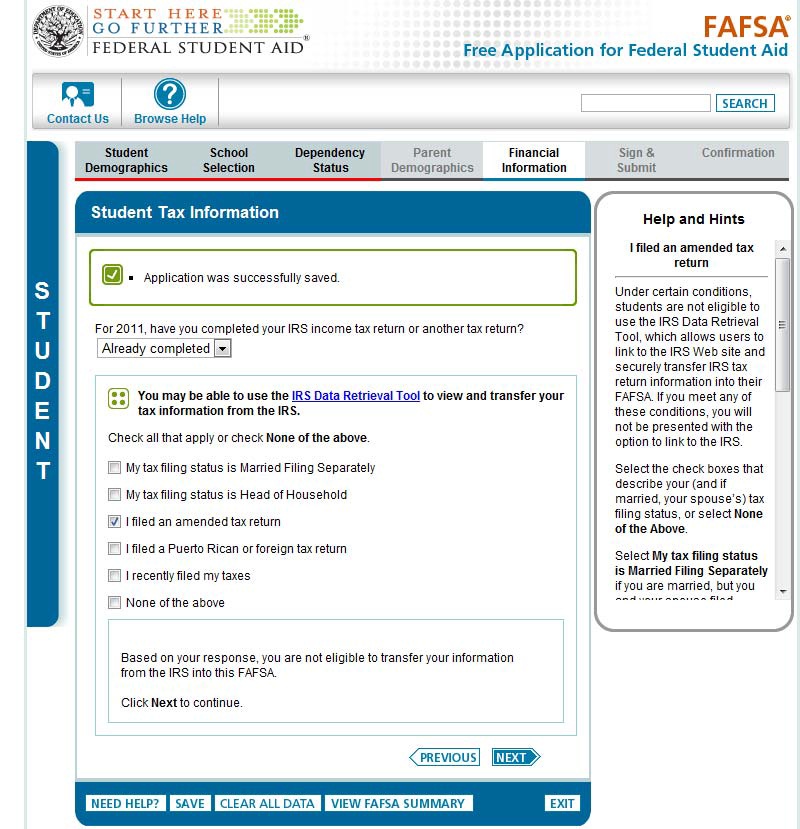

Irs Data Retrieval Process Southern University And A M College

How To Renounce A Us Green Card Gracefully Expat